- Growth Shuttle Insider

- Posts

- The new Operating Partner playbook we deploy in market

The new Operating Partner playbook we deploy in market

How we execute Value Creation + what we see in top OPs across the PE world

Last newsletter dove into the full skill set of the Operating Partner, following the 2026 expectations that mature funds have set (which we’ve seen firsthand).

The complementary traits to executive leadership teams + the board are what makes the role so critical - especially in an era where Financial Engineering is insufficient for value creation where go-to-market initiatives within a RevOps environment show strong output today.

Once the ideal Operating Partner is selected, the next 90 days are critical. And this could go wrong in a million ways without the right onboarding plan and executive alignment.

Rapid diagnostics: universal value triggers in every industry

You can't fix what you don't understand, and time is always of the essence in PE. Operating Partners need robust frameworks to quickly diagnose issues and identify value creation opportunities across diverse industries.

Here's a five-step go-to approach I’ve been executing in DevriX and in my advisory roles stepping into a new fund or a PE company:

1. The "5 Whys" for problem identification

Don't just treat symptoms. When you see a problem (e.g., declining sales, high customer churn), ask "why" five times to get to the root cause.

Example:

Sales are down. Why?

(Leads are low.) Why?

(Marketing campaigns are ineffective.) Why?

(They're targeting the wrong audience.) Why?

(We haven't updated our ICP in 3 years.) Why?

(No one owns the competitive analysis and market research.) Bingo: the root problem isn't marketing execution, it's a lack of ownership in strategic market intelligence.

The core framework was invented by Sakichi Toyoda, Toyota’s founder, in the 1930s and still carries significant weight.

2. Value chain mapping

Graphically represent every step in the company's value creation process - from raw materials (or lead generation) to final delivery and customer support. Identify bottlenecks, areas of waste, and potential for automation or outsourcing.

This works for software companies just as well as manufacturing.

My operations and marketing teams approach that as a set of templates, workbooks, or checklists. Some use Miro to fully visualize that.

Occasionally, I draft this as a Lovable visual map first or sketch it on my tablet during discovery meetings, digitalizing the mindmap after.

3. Customer journey mapping

Understand the customer's experience end-to-end.

Where are the friction points?

What causes churn?

What delights them?

This often reveals opportunities for product improvements, service enhancements, and revenue growth that are overlooked internally.

If the business doesn’t have detailed personas or ICPs mapped out, we prioritize these in the next 30 days, following internal surveys and external ICP interviews where applicable.

This is also included in our web platform migration/consolidation projects with the DevriX framework I shared in July. Conducting a full rebrand/rebuild without the problem-solving exercises is a recipe for disaster.

4. SWOT + PESTLE (external factors)

Two classical framework applicable in PE as well.

SWOT’s matrix covers Strengths, Weaknesses, Opportunities, Threats - applicable to organizational layers, product market fit, mission/vision, departmental efficiency, and individual scorecards.

In the era of AI, I recently presented this to mid-market professionals deciphering the complexity of LLMs and automating core jobs:

Applying the same paradigm across the organization sets the tone and the right direction internally, with a common “enemy” (the outside world).

And use PESTLE (Political, Economic, Social, Technological, Legal, Environmental) to identify external trends and risks that current management might be overlooking.

5. Data deep dive (Source of Truth/Systems of Record)

Before forming any opinions, dive into the actual data – financial statements, CRM data, ERP reports, marketing analytics. Discrepancies between perceived reality and data-backed reality are significant red flags and significant opportunities.

We spend over a thousand hours every month at the office questioning data sources, pipelines, dashboards, while iterating on ETL transformations, building all sorts of logging, alerting, evals, and assessment data to get closer to truth.

Operational friction is the key reason for this when recruitment and product-market fit are both executed effectively. This shaped the short LinkedIn post linked here.

Prepare for Operating Partner engagement by having your data ducks in a row. Clean CRM data, clear sales dashboards, and transparent marketing ROI reports will accelerate their diagnostic process and help them execute upon tactical items sooner.

Reverse recruitment - how to secure the next year as an Operating Partner

As a value creation advisor for different PE companies, I’ve worked with great operators and weak operators. While cultural preferences may vary (what works for some, doesn’t for others), some common traits work better in practice.

An Operating Partner can possess all the frameworks and expertise in the world, but without trust from the management team, their impact will be severely limited. Change is uncomfortable, and people resist it naturally.

Here's how to build those critical bridges:

Lead with empathy and active listening. Don't just storm in with solutions. Spend time understanding the current challenges from the management team's perspective. Ask thoughtful questions. "What keeps you up at night?" "What are your biggest frustrations with current processes?"

Demonstrate value early and often (quick wins). Find small, tangible improvements that can be implemented quickly and show immediate positive results. This builds credibility and creates a positive feedback loop. Helping to streamline a reporting process that saves the finance team 10 hours a week or implementing a simple sales script that immediately increases conversion rates by a few percentage points don’t take forever, but the impact is significant.

Be a partner, not a dictator. Position yourself as an extension of their team, there to augment their capabilities and provide resources, not to tell them they're doing everything wrong. Frame initiatives as “our shared goal” rather than “my mandate."

Transparency and open communication. Be clear about your objectives, your timeline, and your expectations. Address concerns openly and honestly. Over-communicate, especially during periods of change.

Empowerment, not just direction. Guide, coach, and enable the management team to own the solutions and execute the changes themselves. The goal isn't to replace them but to elevate their performance and strategic thinking.

"Roll up your sleeves" mentality. Be willing to get into the trenches. If a sales process needs building, sit in on calls. If a system needs configuring, understand the workflow. This hands-on approach builds immense respect and demonstrates commitment.

And the actionable takeaway for PE firms:

Vet your Operating Partners not just for their technical expertise, but also for their emotional intelligence and ability to build rapport. A technically brilliant but interpersonally awkward OP will struggle to drive lasting change.

Mario

My take

👨🏭 LinkedIn prioritizing games to education - the influx of games on the platform prevents career opportunities.

💼 Why SEO updates don’t carry the same weight as 2015-2022 - what previously was a guiding light for organic search no longer is today. Review from our properties.

💼 AI skill training takes hours, not months. The biggest misconception in all LLM-based solutions today is the premise that it takes as long as it did to pick up skills before. It no longer takes months at a time to watch video courses, read books, and practice 101 engineering or marketing principles to get an MVP or a prototype up. Read more about the skills gap.

Market insights & opportunities

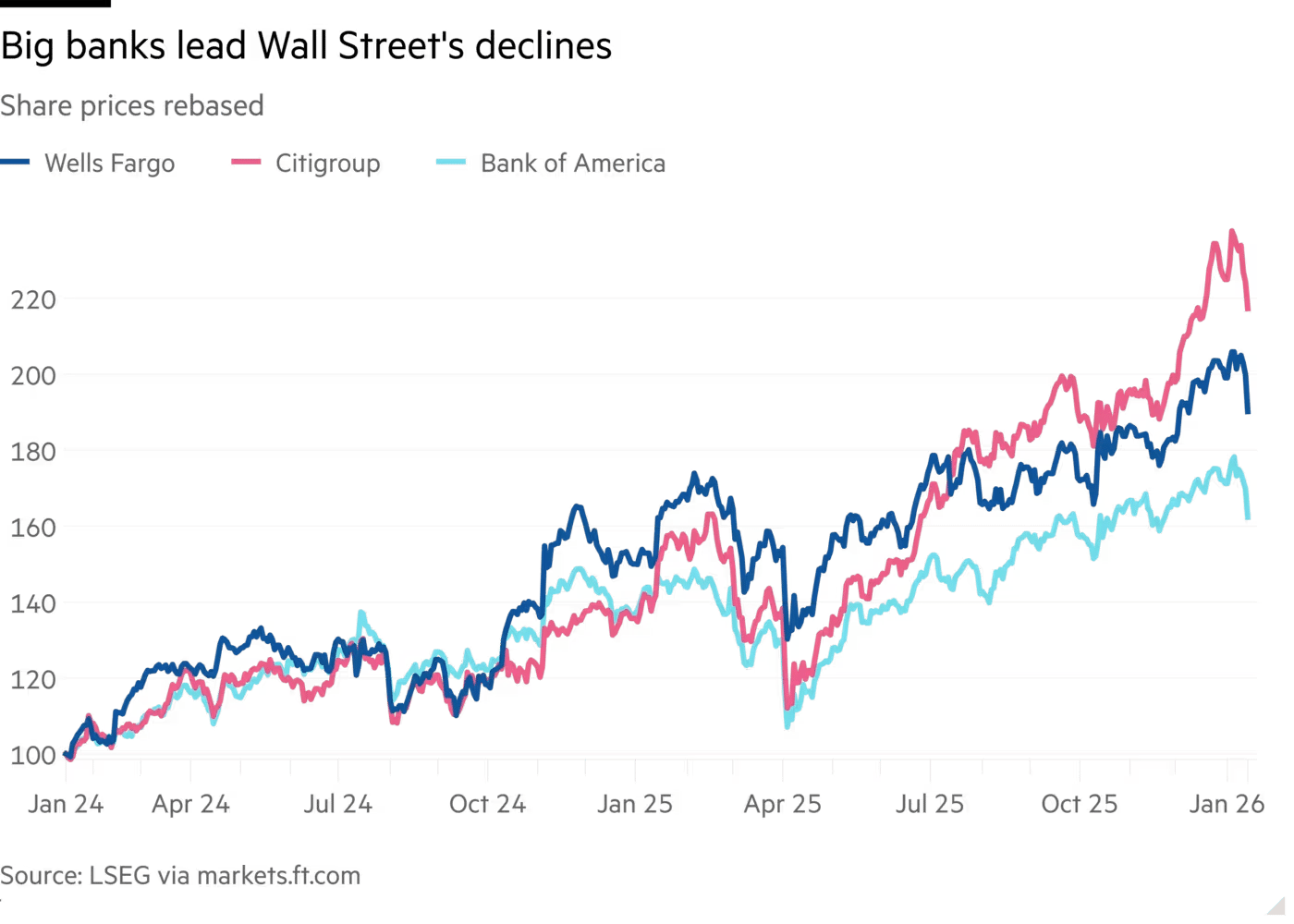

🏦 Bank earnings felt tighter. Major banks delivered a mixed start to earnings season, with narrow margins and uneven contributions across lending and fee units influencing sentiment.

🪙 Rates expectations remain range-bound. Markets continue to price a later easing cycle, signaling sustained cost of capital and caution on aggressive monetary shifts.

🌏 Regional price pressures were pronounced. Consumer inflation in China reached multi-year highs while other economies showed persistent core price momentum.

📈 Commodities extended gains. Commodities broadly advanced, with oil, gold, and silver contributing to a rally despite equity pressure - reflecting geopolitical and supply dynamics on trader radar.

Email Deliverability SaaS: A developer-focused tool for testing and improving email performance, running for 12 years with strong retention and minimal churn (5%). Consistently profitable with $7K monthly profit at 71% margins - available for $265,000.

Defense & Science News Platform: A 19-year-old content business with authoritative SEO and fully automated operations. Generating $84K in monthly profit at 97% margins across 9.7M monthly page views - listed at $2,300,000 (reduced 16%).

Automated Verification Service: A proven SaaS-style verification tool filtering landlines, VoIP, and DNC lists to boost outreach accuracy and ROI. With $40K monthly profit and recurring demand from B2B clients, it’s offered at $5,000,000.

Working with me

🌐 Scaling $30M - $100M+ mid-market companies with value creation through RevOps, data engineering, and WordPress. DevriX provides full RevOps consulting + delivery with GTM enablement for PE-backed portfolio companies, traditional tech, healthcare, finance, and professional service businesses pacing toward revenue growth initiatives. Our standard retainers between $10K and $60K include revenue lifecycle services for marketing and sales leaders, FP&A for financial teams, pipeline enrichment through websites and dozens of lead sources, automations and delivery integrations, CRO and ongoing testing, product delivery and platform integration solutions, and more through our consulting solutions.

🚀 1:1 Consulting. At Growth Shuttle, I run two popular plans: Async Advisory ($3,500/mo) for $3M - $30M founders and executive teams and the smaller Strategic Growth Circle ($997/mo) for $100K - $500K entrepreneurs, agency founders, scale ups. My fractional executive plan is also available here.

📈 Building US LLCs from Europe. I help European and Asian founders scale faster through doola and their “Business in a Box” model. Also suitable for US citizens (given their bookkeeping solution), but in very high demand across Europe.

📊 Post-Merger Integration. I support M&A initiatives through Flippa’s marketplace. Working closely on PMI initiatives for PE companies and fast-growing startups integrating new companies within their portfolios, enabling data pipelines, and securing more deals through my personal network.