- Growth Shuttle Insider

- Posts

- Operational intelligence for PE & RevOps leaders

Operational intelligence for PE & RevOps leaders

The path to doing more with less

Doing “more with less” is one of the key pillars of the decade of “operational efficiency”, starting with Meta’s transformation in 2022 (following Musk’s cleanup of 75% of Twitter’s staff), the years of return to office, the launch of LLMs, and a similar trend in the beginning of 2026.

But running lean is no longer enough.

Lean is table stakes. Intelligence is the edge.

Every market competitor is trying to be lean. They're optimizing, cutting, streamlining. If everyone is doing the same thing, then differentiation looks different.

How do you unlock the kind of exponential growth and margin expansion that defines a successful PE investment?

It’s a combination of trimming fat and building a stronger moat. The myth that "lean" is the ultimate destination often blinds us to opportunities for transformative efficiency and competitive advantage. We're not talking about simply getting by; we're talking about outmaneuvering.

Engineering 20%+ efficiency gains in portfolio companies

The market no longer rewards incremental improvements. It demands significant leaps.

For private equity firms, this translates to driving substantial operational enhancements within portfolio companies, often targeting efficiency gains of 20% or more. This isn't achieved through simple cost-cutting, but a deliberate, structured overhaul of operational methodologies.

As an example, a SaaS portfolio company instrumented its full funnel (marketing → sales → onboarding) and rebuilt RevOps around conversion math instead of intuition.

In 120 days:

Lead-to-SQL conversion: 11% → 18%

Sales cycle: 74 → 49 days

CAC reduced 27%

Rep productivity: +22% pipeline per rep

Revenue per employee: +31%

EBITDA margin improvement: +6.4 pts

No additional headcount. Just process visibility + automation.

The systems layer that unlocks 20-30% gains

These are not point tools or isolated initiatives. They are compounding capabilities that, when deployed together, permanently change how a company operates.

Integrated Digital Transformation & Automation: This isn't just about implementing an ERP. It’s about a holistic approach where processes are re-engineered before automation.

Process Mining & Discovery: Utilizing tools like Celonis or UIPath Process Mining to visualize actual process flows, identify bottlenecks, and quantify waste before any tech implementation. This provides data-backed evidence for inefficiencies that might otherwise be overlooked.

Workflow Orchestration Platforms: Moving beyond individual point solutions to platforms that connect disparate systems and automate end-to-end workflows (e.g., integrating CRM, ERP, marketing automation, and customer service platforms for a unified customer journey).

AI-Powered Decision Support Systems: Implementing AI to analyze vast datasets, predict demand, optimize inventory, or even guide sales and marketing strategies, leading to proactive rather than reactive operational decisions.

"As-a-Service" models

Shifting from capital expenditure to operational expenditure for key functions, enabling greater flexibility, lower upfront costs, and access to cutting-edge technology as it evolve

For PE Leaders:

Before sanctioning any significant IT spend, insist on a thorough process mining exercise. You can't optimize what you don't truly understand.

Embed dedicated RevOps expertise to drive these top-down operational transformations, ensuring alignment between sales, marketing, and service.

Actively question whether existing "lean" principles are holding back true innovation. Sometimes, a strategic investment in automation or AI will yield far greater returns than another round of cost-cutting.

For RevOps Leaders:

Champion the use of data to identify bottlenecks and quantify the opportunity cost of inefficient processes. Your recommendations will carry more weight.

Break down siloed thinking. Your role is to optimize the entire revenue engine, from first touch to post-sale support.

Don't wait for problems to arise. Explore where intelligent automation can not only reduce costs but also enhance customer experience and unlock new revenue streams.

This isn’t theory. It’s the operating standard.

Here’s the checklist every Operating Partner should run across their portfolio →The Operating Partner's 2026 checklist to cover in every portfolio firm

Moral of the story

The message is clear. "Lean" is table stakes. To truly outperform, you need to embed intelligence and strategic automation into every facet of your portfolio companies’ operations.

To your accelerated growth,

Mario

My take

🚀 Anyone can ship fast now. Few can compound trust and proprietary data over years. Time in market is the moat - or the tax.

🤖 Practical notes from using LLMs in portfolio ops. Lessons from deploying LLMs across mid-market ops ($40M-$300M): automation works, agents are still early, and governance > hype.

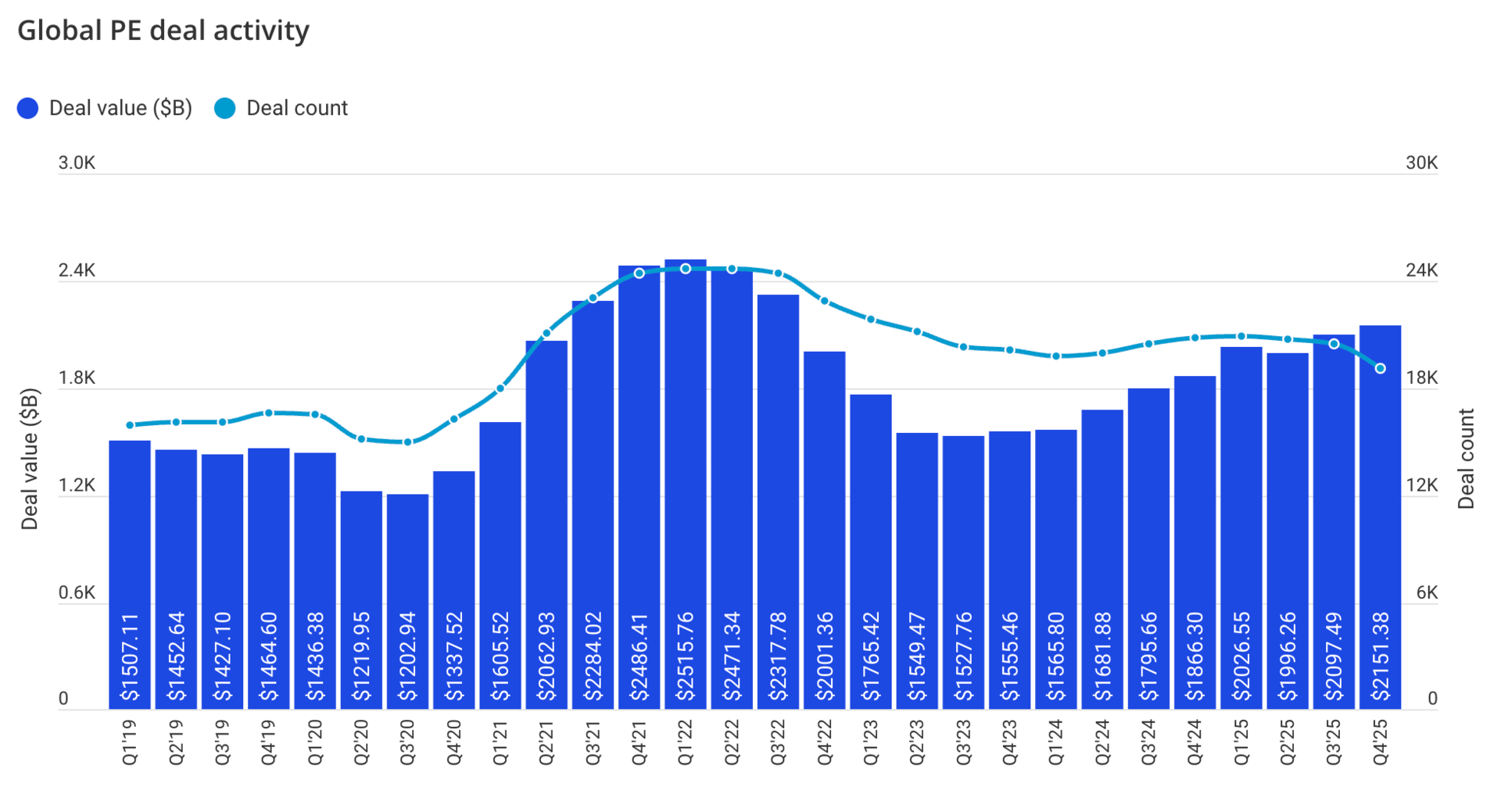

Market insights & opportunities

Source: Pulse of Private Equity Q4'25 KPMG analysis of global private equity activity as of 31 December 2025.

Enterprise DLP modernized. $32M round backs Orion’s agent-based architecture focused on preventing data exfiltration without manual rules or policy overhead.

Fiber consolidation continued. AT&T closed its $5.75B acquisition of Lumen’s mass-market fiber assets, adding 1M+ subscribers and expanding its footprint across 32 states.

Information risk entered the enterprise stack. Refute’s ~$7M seed round signals rising spend on real-time detection of manipulation campaigns targeting corporates, not just states.

Operational AI funding accelerated. Alaffia Health raised $55M to automate claims review and reduce payer waste, signaling capital flowing into back-office efficiency over clinical AI.

AI Design SaaS: A 3-year-old AI-driven design platform helping marketers and creators produce visuals faster than traditional methods for over 4M users. Generating $17K in monthly profit at 67% margins with 1,300 subscribers, it’s listed at $990,000.

Education SaaS: A fully automated AI learning assistant with 6.7K users and stellar Trustpilot reviews (4.6/5). Boosts student performance with minimal churn (10%) and strong retention - available for $58,872 (EUR €50,368).

Amazon Ads SaaS: An AI-powered SaaS automating Amazon Ads for KDP authors, leading in an untapped publishing niche. $21K MRR, 700 subscribers, and 5% churn. High potential and massive discount - reduced 70% to $221,365.

Working with me

🌐 Scaling $30M - $100M+ mid-market companies with value creation through RevOps, data engineering, and WordPress. DevriX provides full RevOps consulting + delivery with GTM enablement for PE-backed portfolio companies, traditional tech, healthcare, finance, and professional service businesses pacing toward revenue growth initiatives. Our standard retainers between $10K and $60K include revenue lifecycle services for marketing and sales leaders, FP&A for financial teams, pipeline enrichment through websites and dozens of lead sources, automations and delivery integrations, CRO and ongoing testing, product delivery and platform integration solutions, and more through our consulting solutions.

🚀 1:1 Consulting. At Growth Shuttle, I run two popular plans: Async Advisory ($3,500/mo) for $3M - $30M founders and executive teams and the smaller Strategic Growth Circle ($997/mo) for $100K - $500K entrepreneurs, agency founders, scale ups. My fractional executive plan is also available here.

📈 Building US LLCs from Europe. I help European and Asian founders scale faster through doola and their “Business in a Box” model. Also suitable for US citizens (given their bookkeeping solution), but in very high demand across Europe.

📊 Post-Merger Integration. I support M&A initiatives through Flippa’s marketplace. Working closely on PMI initiatives for PE companies and fast-growing startups integrating new companies within their portfolios, enabling data pipelines, and securing more deals through my personal network.