- Growth Shuttle Insider

- Posts

- When revenue growth is a misleading PE indicator

When revenue growth is a misleading PE indicator

Practical examples how discounting, feature creep, and expansion quietly backfire

Year-over-year growth is a good investment story when debt restructuring is due, but it isn’t a guaranteed company accelerator. This has been proven to be the case across thousands of companies ever since the 2022-2023 cuts began in big tech and corporate.

As a PE firm or a RevOps leader, your gut - and your spreadsheets - often tell a more nuanced story. Is that growth truly profitable? Or are we, in our relentless pursuit of top-line expansion, unwittingly stepping into “growth traps” that drain resources while yielding diminishing returns?

In today's edition of Growth Shuttle Insider, we're moving beyond the vanity metrics. We're cutting through the noise to focus on what truly matters for long-term value creation: deep-diving into unit economics and building sustainable scaling practices. This isn't just about shaving a few dollars off expenses; it's about fundamentally reshaping how you view and execute growth to ensure every dollar invested delivers a disproportionate return.

Many companies, especially those under intense PE scrutiny, fall victim to what I call "growth traps." These are initiatives or strategies that, on the surface, drive revenue, but upon closer inspection, erode margins, increase operational complexity, or distract from core value propositions.

3 common growth traps to watch for:

Discounting as a primary acquisition strategy. While effective for short-term bumps, perpetual discounting can attract price-sensitive customers with low lifetime value (LTV) and devalue your product or service. This often leads to increased churn and a race to the bottom.

Feature creep driven by a vocal minority. Adding numerous features to please a small segment of customers can bloat your product, increase development and support costs, and obscure your core value proposition for the majority. Each new feature needs to justify its ROI, not just its existence.

Expanding into marginally profitable markets/segments. Entering new geographical regions or customer segments without a robust understanding of acquisition costs, operational overheads, and competitive landscape. The incremental revenue might not offset the disproportionately higher cost-to-serve.

The clear answer to individual KPI blindness is intelligent, data-driven decision-making. For PE firms and RevOps leaders, this means moving beyond aggregated reporting to granular insights that reveal the true cost and value of every customer interaction and operational process.

Actionable levers for data-driven optimization

1. Calculate LTV:CAC ratio reliably

This isn't just a marketing metric. Include all costs associated with acquiring and serving a customer (sales commissions, onboarding, support, allocated dev resources for features they use). A healthy ratio is typically 3:1 or higher. Below 2:1 indicates a fundamental profitability issue.

1.1. Segment your customer base by profitability. Not all customers are created equal. Identify your most profitable segments and double down on them. Conversely, understand which segments are a net drain and recalibrate your acquisition strategies or even consider off-boarding.

1.2 Map customer journeys to cost centers. Understand the cost associated with each touchpoint - from initial ad impression to post-purchase support. Pinpoint areas where costs are disproportionately high relative to their impact on conversion or retention.

2. Optimizing marketing spend beyond blended CAC

2.1 Channel-specific LTV:CAC. Don't just look at overall CAC. Analyze the LTV:CAC for each marketing channel. A channel with a higher CAC might be highly profitable if it brings in customers with significantly higher LTV and lower churn.

2.2. Experiment with smaller and targeted campaigns. Before pouring millions into broad campaigns, run micro-experiments to identify optimal messaging, audiences, and channels that yield the best return on ad spend (ROAS) and customer quality.

3. Operational efficiency as a growth driver

Free up your high-value employees (sales, customer success) from administrative overheads. Tools for lead enrichment, contract generation, or basic customer support can dramatically improve efficiency and reduce cost-to-serve.

3.1 Streamline onboarding and support processes. A clunky onboarding process increases churn and support costs. Invest in self-service knowledge bases, intuitive product design, and efficient support staff training to reduce reliance on costly one-to-one interactions.

3.2 Vendor consolidation and optimization. Regularly review your tech stack and vendor relationships. Are you paying for redundant tools? Can you negotiate better terms with existing providers based on volume or long-term commitment?

The framework for balancing aggressive growth with robust profitability

My approach to scaling is rooted in a fundamental principle: growth fueled by strong unit economics is sustainable; growth at any cost is a ticking time bomb. Here’s a simplified framework I use with portfolio companies and leadership teams:

Define your North Star metric (profit-adjusted). Beyond just "revenue growth," identify a metric that intrinsically ties growth to profitability. This could be "Gross Margin % Growth," "Customer LTV Growth," or "EBITDA Growth per FTE."

Establish clear guardrails. Before embarking on new growth initiatives, define your non-negotiables: Minimum LTV:CAC Ratio: Never drop below this threshold for any new customer acquisition channel. Maximum Customer Churn Rate: Identify a benchmark and actively work to stay below it. Gross Margin Targets: Ensure new products/services contribute positively to overall gross margin, not just revenue.

Iterative hypothesize, test, learn (HTL). Hypothesize: Identify a growth opportunity (e.g., "expanding into this new segment will yield 4x LTV:CAC"). Test: Run a controlled, measurable experiment with a defined budget and timeframe. Learn: Analyze the data rigorously. Did it meet your profitability guardrails? If not, pivot quickly. If yes, scale intelligently.

Align incentives. Ensure that compensation structures for sales, marketing, and even product teams are tied not just to top-line revenue, but also to profitability metrics (e.g., net new ARR profitability, retention rates, or expansion revenue). This transforms individual priorities into collective financial success.

The current economic climate demands more than just growth - it demands intelligent growth. By focusing on sustainable practices and leveraging data to understand true profitability, you can build resilient, high-value companies that weather any storm and continue to deliver exceptional returns.

To your profitable growth,

Mario Peshev

My take

💼 On-site roles are a defensibility strategy in today’s market. I was an early ambassador on telecommuting and distributed work in 2007-2010, but later on moved to defending on-site. With millions of applicants failing to land interviews, this is a default answer.

💼 Our hiring scales as we add more agents. Contrary to the popular belief, this accelerated our recruitment.

🤖 Examples of agentic integrations for internal use.

Market insights & opportunities

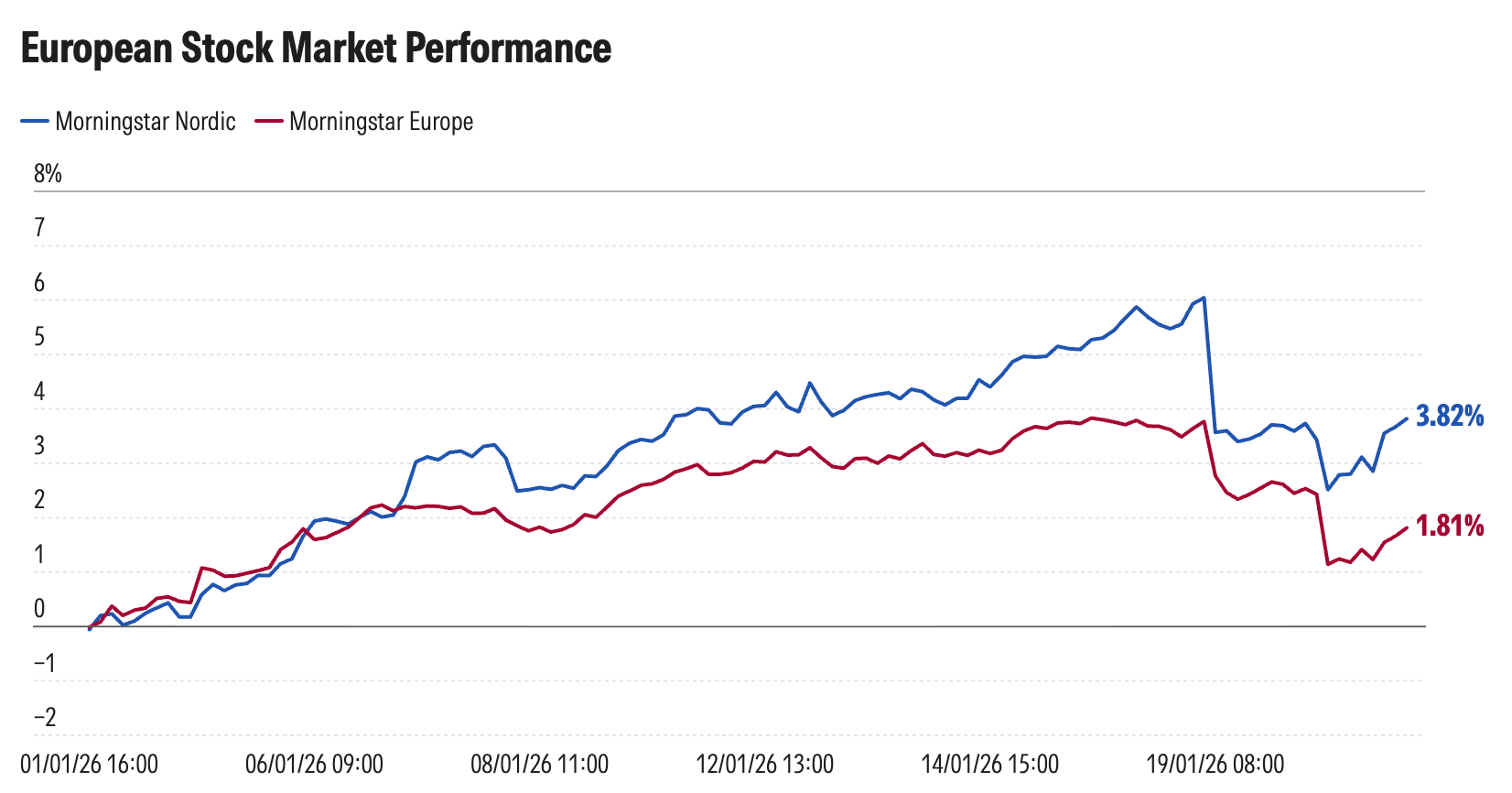

Source: Morningstar. Data as of Jan. 20, 2026, 16:00

📉 Trade policy risk weighed on regional sentiment. Equity gains retraced as tariff threats resurfaced, reinforcing short-term volatility in intra-January market performance tracking.

🪙 Rate-cut expectations pushed out. With December CPI unchanged at 2.7% YoY, inflation data reduced urgency around easing, leading markets to scale back expectations for imminent Fed rate cuts.

🏦 Safe-havens surged amid turmoil. Gold hit all-time highs, Swiss franc strengthened, and 10Y Treasury yields spiked to August peaks as investors fled risk assets while the U.S dollar weakened notably against majors.

📈 JGB yields spiked. Japanese long-dated bond yields hit multi-decade highs amid tightening conditions.

Email Automation SaaS: A lightweight Gmail automation SaaS that sends recurring emails via a Chrome and Workspace extension. 99% profit margins, 1,400 active subscribers, and 3% churn - a simple yet lucrative model priced at $350,000.

Orthopedic Footwear eCommerce Store: A 6-year-old Shopify store selling bunion and orthopedic shoes made with premium materials for comfort and durability. Generating $3.2K in monthly profit at 10% margins and over 130K monthly visitors, it’s available for $64,152 (reduced 35%).

Automated Verification SaaS: A proven 4-year-old B2B platform that improves call and SMS outreach accuracy by filtering landlines, VoIP, and DNC lists. Earning $40K in monthly profit and built for recurring revenue, it’s offered at $5,000,000.

Working with me

🌐 Scaling $30M - $100M+ mid-market companies with value creation through RevOps, data engineering, and WordPress. DevriX provides full RevOps consulting + delivery with GTM enablement for PE-backed portfolio companies, traditional tech, healthcare, finance, and professional service businesses pacing toward revenue growth initiatives. Our standard retainers between $10K and $60K include revenue lifecycle services for marketing and sales leaders, FP&A for financial teams, pipeline enrichment through websites and dozens of lead sources, automations and delivery integrations, CRO and ongoing testing, product delivery and platform integration solutions, and more through our consulting solutions.

🚀 1:1 Consulting. At Growth Shuttle, I run two popular plans: Async Advisory ($3,500/mo) for $3M - $30M founders and executive teams and the smaller Strategic Growth Circle ($997/mo) for $100K - $500K entrepreneurs, agency founders, scale ups. My fractional executive plan is also available here.

📈 Building US LLCs from Europe. I help European and Asian founders scale faster through doola and their “Business in a Box” model. Also suitable for US citizens (given their bookkeeping solution), but in very high demand across Europe.

📊 Post-Merger Integration. I support M&A initiatives through Flippa’s marketplace. Working closely on PMI initiatives for PE companies and fast-growing startups integrating new companies within their portfolios, enabling data pipelines, and securing more deals through my personal network.