- Growth Shuttle Insider

- Posts

- RevOps in Private Equity - implementing in practice

RevOps in Private Equity - implementing in practice

The massive revenue and FP&A driver for PE roll ups

Good morning from me as we’re burning the midnight oil over the busiest month of the year (shopping holidays, Black Friday deals, 2026 roadmap planning, closing new business for next year).

I’ve spent a third of my time in Q3 and Q4 with private equity leaders discussing revenue transformations during post-merger integrations, while exploring new M&A deals, or revamping current portfolio companies.

In the context of private equity, every basis point of efficiency and every percentage point of growth can differentiate a good acquisition from a stellar one. Between financial engineering and operational streamlining, revenue generation isn’t mapped out as a professional analyst or PE partner would expect across most $30M - $60M companies looking into an exit.

For years, sales, marketing, and customer success have operated in silos, each with its own targets, technologies, and often, competing priorities.

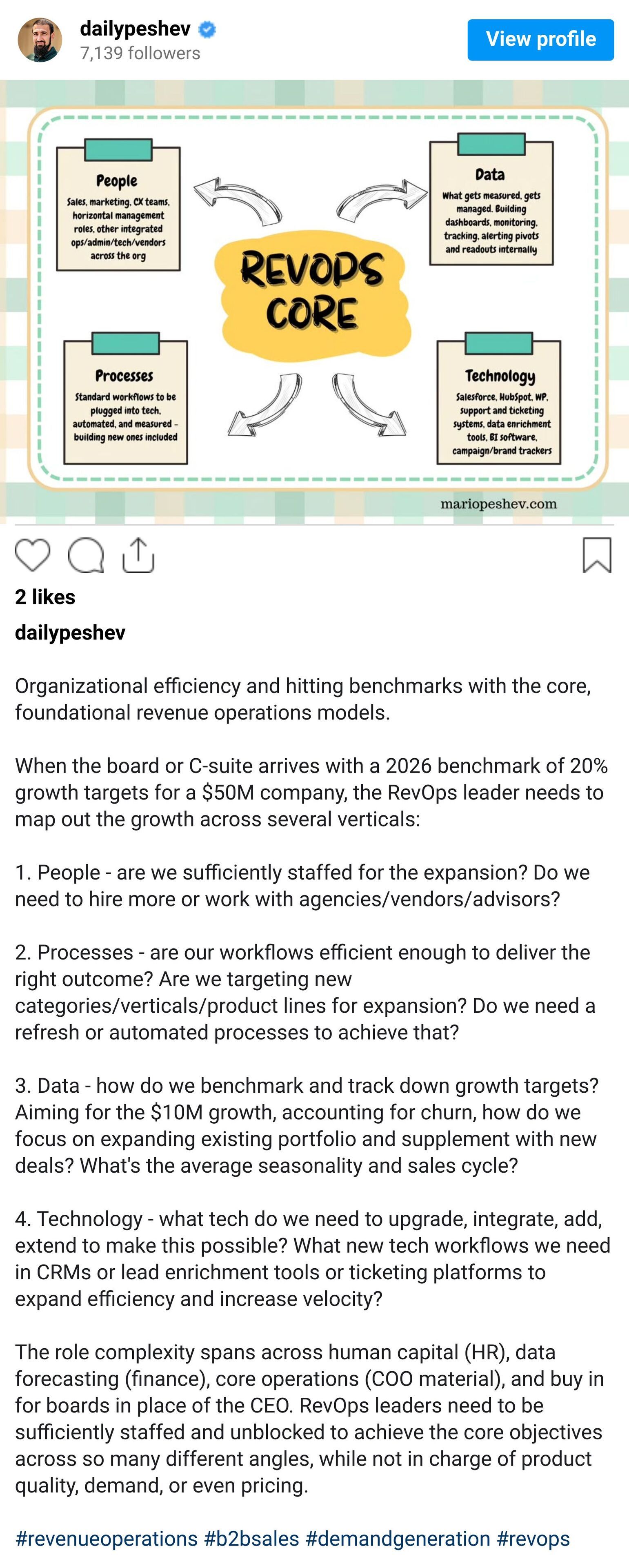

This is where Revenue Operations (RevOps) has been gaining popularity over the past couple of years. Private equity firms are looking for established and proven frameworks and methodologies to grow, optimize, and run their port cos effectively. RevOps is the glue that aligns people, processes, and technology across the entire customer lifecycle, translating directly into tangible ROI.

Async advisory seat: $2,100/mo offer just this month

Since I’m working closely with a handful of PEs and VC funds, my Async Advisory program (standard plan is $3,500/mo) is now available at a 40% discount. The original plan is available here: https://asyncadvisor.com/

My advisory services running for a decade+

Until the end of November, newsletter subscribers and warm referrals may secure their 2026 by signing up at $2,100/mo instead here: https://buy.stripe.com/5kQ3cw7t09sx7tT461gjC0a

The link is capped at 4 new members - first-come, first-served.

Breaking down RevOps for Private Equity

In the context of software engineering, we talk about containerization and orchestration of complex systems in a cloud environment.

RevOps is the air traffic controller for your revenue engines.

It provides the strategic oversight, process optimization, and data intelligence needed to ensure every customer journey is efficient, coordinated, and executed successfully.

What RevOps isn't: It's not just a fancy name for sales operations or marketing operations.

What RevOps is: A holistic function designed to maximize revenue generation by:

Breaking down silos: Unifying sales, marketing, and customer success under a common operational framework.

Optimizing for data visibility: Providing a single source of truth for all revenue metrics, enabling accurate forecasting and strategic decision-making.

Optimizing processes: Streamlining workflows across the customer journey to reduce friction and improve efficiency.

Maximizing technology use: Ensuring CRM, marketing automation, and other tools are integrated and utilized effectively (as companies have overspent on tech over the past years).

Improving accountability: Establishing clear KPIs and ownership for revenue-generating activities.

For PE firms, the ROI is direct: increased revenue velocity, higher customer lifetime value (CLTV), reduced customer acquisition costs (CAC), and ultimately, a more attractive valuation at exit.

Identifying common revenue blockers within portfolio companies with RevOps

Every portfolio company, regardless of its industry or stage, is blocked in multiple places, preventing growth.

Many of these challenges can be overcome post-acquisition by fueling capital into the right initiatives. But unless companies are clear on the right levers, this can’t be executed effectively.

Here are some common culprits and how a RevOps approach provides the remedy.

Problem 1: Inconsistent sales processes and lack of forecasting accuracy

Sales teams operating with disparate methodologies, poor data hygiene, and overly optimistic (or pessimistic) forecasts that never materialize.

How does RevOps help?

Standardizing sales playbooks, implementing robust CRM data governance, providing AI-driven forecasting tools, and establishing clear lead scoring and qualification criteria, leading to more predictable revenue generation.

Problem 2: Disconnected customer journey and poor hand-offs

Leads falling through the cracks, awkward transitions between marketing and sales, or sales closing a deal that customer success isn't prepared to onboard effectively.

What is the RevOps outcome in this scenario?

Mapping the entire customer journey, designing seamless hand-off protocols, integrating communication tools, and ensuring that CRM data flows effortlessly, resulting in higher conversion rates and improved customer satisfaction.

Problem 3: Suboptimal technology utilization and redundant tools

The SaaS era of 2016-2021 brought in an endless line of sales, marketing, and service tools that don’t integrate, leading to manual data entry, data discrepancies, and underutilized features.

RevOps is here to both optimize costs and increase usage. Conducting a comprehensive tech stack audit, consolidating redundant platforms, implementing strategic integrations, and ensuring that teams are properly trained to customize and use these tools for maximum impact, reducing operational costs and increasing efficiency.

Problem 4: Lack of alignment between marketing, sales, and customer success goals

I grew in the era of “Smarketing”, as coined by HubSpot as a synergy between “sales” and “marketing”.

If you’ve been following the newsletter for a while, I’ve also recommended “The Sales Acceleration Formula” by Mark Roberge, HubSpot’s number 1 sales person who brought the company from $1M to $100M while being an MIT tech person, not a traditional salesman.

Today, marketing generates unqualified leads, sales sells features CX can’t deliver, or customer success identifies churn risks that don't inform sales or marketing strategies.

RevOps bridges the gap again. Establishing shared KPIs, facilitating regular cross-functional meetings, aligning compensation structures, and implementing closed-loop reporting to ensure feedback loops drive continuous improvement across all revenue functions.

Actionable Steps for PE Firms to assess and integrate RevOps capabilities

If we have to simplify and organize the RevOps integration process for PE in several steps, this is a sample action plan.

1. Conduct a portfolio-wide RevOps audit

Understand the current state of revenue operations maturity across key portfolio companies.

Engage an external expert (or internal task force) to assess sales, marketing, and customer success processes, technology stacks, data quality, and organizational alignment. Identify critical bottlenecks and opportunities for synergy.

Generate a detailed report outlining each company's RevOps strengths, weaknesses, and potential ROI from strategic improvements.

2. Pilot the high-potential portfolio companies

Implement tangible RevOps actions and measure results in a controlled environment before a broader rollout.

Select 1-2 portfolio companies with clear revenue challenges and high growth potential. Invest in dedicated RevOps leadership (interim or permanent) and necessary technology integrations.

Focus on quantifiable improvements in key revenue metrics and a documented playbook for future implementations.

3. Build a shared RevOps Playbook and knowledge base

Create a standardized approach and best practices that can be replicated across the portfolio.

Document successful strategies, technology configurations, data governance policies, and training materials. Share learnings and instill adoption across the portfolio company’s RevOps leaders. This is very important.

Build a centralized resource hub that accelerates RevOps adoption and maturity.

4. Integrate RevOps into due diligence and roadmapping

Proactively identify RevOps opportunities during acquisition and plan for their integration post-acquisition.

Include RevOps expertise in your due diligence team to evaluate a target company's revenue engine resilience and scalability. Build RevOps initiatives directly into your 100-day and 1-year value creation plans.

Derive more accurate pre-acquisition valuations and clearer post-acquisition revenue growth strategies.

5. Invest in RevOps talent and training

Ensure portfolio companies are staffed effectively to execute and maintain RevOps initiatives.

Support the hiring of dedicated RevOps leaders, provide training for existing sales, marketing, and customer success teams on new processes and tools, and consider shared RevOps resources across smaller portfolio companies.

Build a skilled workforce capable of driving sustained revenue growth.

RevOps will grow further in 2026

We see this clearly in our pipeline, overflowing in demand for the coming year. Private equity companies and VC startups post series B, along with old-school, traditional businesses looking for a stable, resilient framework forward.

Many of our engagements start with the idea of a “rebrand” or a “CRM consolidation”, ending up in a complete 2026 roadmap.

I get calls from hedge funds and institutional investors trying to map 2026 with proven and predictable frameworks.

Use the frameworks in this model to inform decisions and build the right playbook for next year. We’ve hired 8 new people in Q3 and hiring 5 more until the end of the year to fill in the ranks for our pipeline in Q1 and Q2 already. Demand for RevOps is going to follow this trajectory for the next year or two at least.

Mario

My Take

📚️ Books I read this month

“The Algebra of Wealth” by Prof. Scott Galloway (55% in)

“The Hard Thing About Hard Things” by Ben Horowitz (70% in)

“The Sweaty Startup” by Nick Hueber (85% in)

Ray Dalio’s “How Countries Go Broke: The Big Cycle” (55% in)

The FP&A Handbook: Mastering Financial Planning & Analysis (40% in)

“Revenue Architecture” by Jacco van der Kooij (55% in)

“Hooked” - on habits and cues and product alignment ✅

📸 My WordCamp Minute interview - as WordCamp Sofia is approaching, here’s a podcast episode for The WP Minute I was invited to.

⌚️ Making SMART goals work for you - simple ways to build better habits and apply SMART goals effectively.

More from Our B2B Ecosystem

🔖 Follow a structured privacy approach. Use these recommended NIST Privacy Framework steps to align data governance with your company’s privacy goals.

🔖 Rethink sustainability with consulting leaders. See how top firms are helping companies link ESG initiatives to supply chain efficiency and profits.

🔖 Stay compliant with remote team file sharing. This compliance guide covers encryption, access controls, and audit readiness for dispersed teams.

🔖 Translate strategy into metrics that matter. Explore scorecard case studies showing how to turn company goals into actionable KPIs.

🔖 Build products by fixing your own problems. AWS shows how solving internal issues can lead to revenue-generating platforms that scale far beyond the original use case.

🔖 Speed beats perfect data in growth strategy. This CRM case study highlights how over-optimizing cost a company 40% of its market.

🔖 Use goals that matter to you. This SMART goal guide shows how deep motivation helps achieve results better than rigid planning.

Industry News for B2B Leaders

📰 Startup hits nuclear milestone. Valar Atomics becomes first private firm to reach cold criticality in DOE pilot via critical reactor test.

📰 Goldman warns on AI bubble. Bank highlights $19 trillion premium may outpace fundamentals in market analysis.

📰 Apple plans succession. Tim Cook’s possible departure prompts investor focus on leadership shift in succession shift.

📰 Trump cuts food tariffs. New exemptions aim to ease grocery costs ahead of 2026 midterms in midterm campaign season.

📰 BNPL risks grow. Capital One co-founder warns rising buy now pay later use poses systemic financial threats in critical analysis.

📰 Tariffs pressure CEOs. Trump’s policies shift focus from innovation to compliance in tariff complications.

📰 Amazon rebrands satellite unit. Project Kuiper becomes Amazon Leo, signaling new enterprise push in brand update.

📰 Japan-tailored AI takes off. Sakana AI raises $135M to build local large language models in sovereign AI innovation.

📰 Investor scrutiny grows. Mersana’s $55.25 share sale to Day One faces questions on undervaluation in legal review.

📰 Sofinnova raises €650M. Sofinnova Partners secures funding for early healthcare startups in Capital XI fund.

📰 Doha freeport bolsters art trade. Qatar opens facility ahead of Art Basel Doha to expand cultural logistics in global art economy.

📰 CMOs struggle with AI search. Most marketers lack clear metrics despite focus on Generative Engine Optimization in AI search success metrics.

📰 B2B firms miss ABM targets. Many companies struggle to implement account-based marketing at scale in practical guide.

M&A Opportunities

Let’s see the latest offers from Flippa. Don’t forget to sign up for their newsletter for daily/weekly/monthly offers like these.

Education SaaS Platform: A fast-growing SaaS business serving the education sector with $634K in annual revenue and 50% margins. Established two years ago, it’s already showing strong retention and steady recurring income - listed at $862,490.

Word Puzzle Mobile App: A fun, fast-paced Android word puzzle game boasting over 100K installs and stellar user ratings. Designed for multiplayer play and continual engagement, it runs at 93% profit margins - available for $179,999.

Video Automation SaaS: An 11-year-old, patent-backed SaaS platform enabling automated video creation for global brands. With $46K in monthly profit and strong enterprise adoption, this high-margin business is priced at $7,000,000.

Finance Comparison Website: A well-established content site focused on finance reviews and comparisons with powerful SEO authority. Generating consistent profit through long-term brand partnerships, it’s offered at $749,999.

E-commerce Service Platform: A scalable e-commerce operation built for high-margin performance, achieving over $47K monthly profit. With solid growth metrics and operational efficiency, this business is selling for $1,200,000.

Herbal Tea FBA Brand: A leading Amazon FBA brand specializing in natural herbal tea products with a 100% US customer base. Fully passive for the owner and generating $78K monthly profit, it’s available for $3,481,348 (excluding inventory).

Working with me

Here are the main projects I focus on:

🌐 Scaling $30M - $100M+ companies on top of WordPress. DevriX provides full RevOps consulting + delivery with GTM enablement for PE-backed portfolio companies, traditional tech, healthcare, finance, and professional service businesses pacing toward revenue growth initiatives. Our standard retainers between $10K and $40K include revenue lifecycle services for marketing and sales leaders, FP&A for financial teams, pipeline enrichment through websites and dozens of lead sources, automations and delivery integrations, CRO and ongoing testing, product delivery and platform integration solutions, and more through our consulting solutions.

🚀 1:1 Consulting. At Growth Shuttle, I run two popular plans: Async Advisory ($3,500/mo) for $3M - $30M founders and executive teams and the smaller Strategic Growth Circle ($997/mo) for $100K - $500K entrepreneurs, agency founders, scale ups.

📈 Building US LLCs from Europe. I help European and Asian founders scale faster through doola and their “Business in a Box” model. Also suitable for US citizens (given their bookkeeping solution), but in very high demand across Europe.

📊 Post-Merger Integration. I support M&A initiatives through Flippa’s marketplace. Working closely on PMI initiatives for PE companies and fast-growing startups integrating new companies within their portfolios, enabling data pipelines, and securing more deals through my personal network.