- Growth Shuttle Insider

- Posts

- Management secrets, ads shutting down, AI for everyone

Management secrets, ads shutting down, AI for everyone

Closing December with key lessons on management, resources for the holidays, and financial retrospections

December is taking a break from RevOps and Private Equity conversations as other paradigms take precedence amidst the hundred conversations here over the past 2 months:

Meeting former FAANG employees laid off 2 years ago, still unable to land jobs

Hundreds of CVs applying for the wrong jobs with no context whatsoever

Executive conversations behind closed doors because decisions or roadmaps are unpopular

Rapid shifts by core leadership based on investor opinions regarding management decisions - overemployment vs. R&D spend vs. work-life balance vs. WFH for safety vs. “optimizing for efficiency” vs. “investing in AI” vs. “AI does not deliver GDP growth”, among others

Disparity between the top 10% of employees maximizing LLM use and most of the market still unaware of the opportunities in the first place

The drastic shift between “servant leadership” popular in the late 2010s and start of 2020 and the actual data-driven management today

The future of jobs and responsibilities + educational conundrums

Macroeconomic headwinds

A simplified example today is the recurring layoff rounds happening over and over again. Up until early 2022s, any cuts were perceived as poor management, inhumane violation of the bond between the corporation and the job market, incompetent hiring skills, and regressive product proposition.

Moreover, dozens if not hundreds of skilled engineers and R&D researchers were known to be hired and benched just to avoid leaking know-how to competing parties.

The market is different today. Ongoing layoffs are “acceptable” if not “required” to achieve “operational efficiency”. ⬇️

Same management teams, same products, same business models.

The only difference is societal perception and how the mass media perceives executive actions.

The widespread management secrets causing whiplash

The most epic discrepancy on the market since the early 2010s has been the indirect promise of “together in good and bad times”.

But what has become evident in the past 3 years is that the job market is no different from the employee market in the past years - or rather, loyalty is nearly impossible to find:

It’s bi-directional of course, we just had someone hired 3 months ago in the rough job market resigning this week as he heard back from a previous teammate and got an offer in a funded UK startup. Since it goes both ways, the market is more turbulent than it’s been in the 2010s.

Management follows market trends - it was simply up for 10+ years

Younger millennials and gen Z probably don’t have a recollection of the 2008 Great Recession, let alone the dot com. Therefore, a healthy market going up consistently was the only economy many on the job market know or remember.

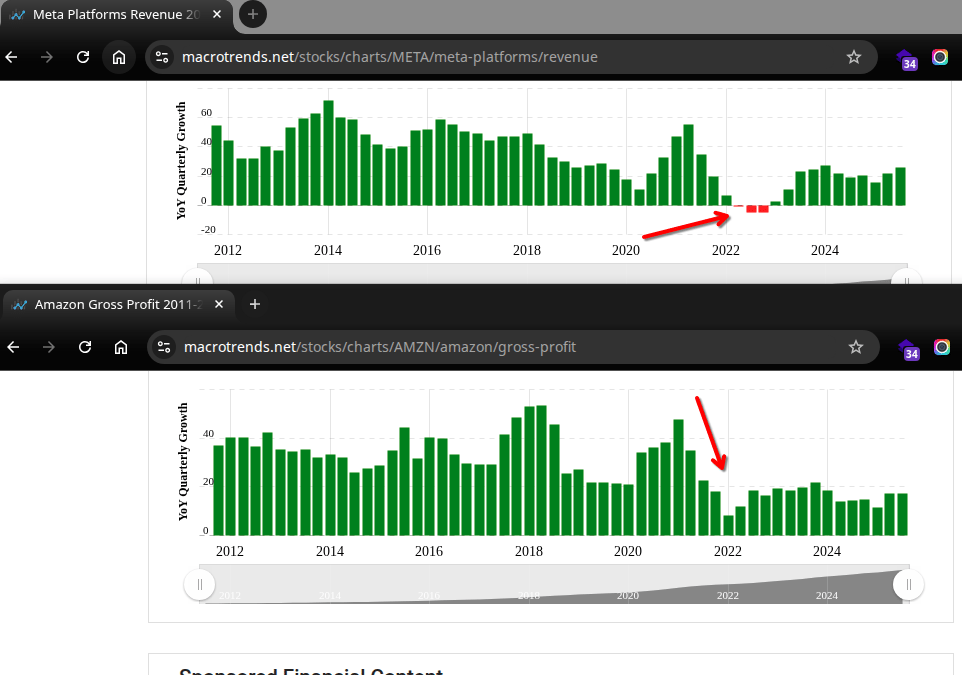

And if the 2022-2023 layoff rounds seem surprising, they shouldn’t. A simple look into corporate performance clearly defines what is happening - here are Meta and Amazon as two examples:

Meta and Amazon performance in 2022 leading to cuts

You can see how quarterly growth for high-tech companies has been going through the roof for a decade. Small turbulence around the first months of covid, and scaling back up after.

Until a pretty steep market in 2022 when investors said “enough” - and suddenly, job cuts and “optimizing for efficiency” became the norm.

I’ve been following Ben Horowitz closely over the past few months: 📝

Watch his futuristic talk for Columbia Business School and recapped in my blog

Read his The Hard Thing about Hard Things - also disclosing how management books are written in peaceful times and therefore, friendly and supporting (and nobody invests in guides for managers during terrible economies and restructuring - it’s not investable nor popular)

Followed his appearance on the My First Million podcast, with tons of valuable nuggets like: “management tends to be like that in that it really has to do a lot with your situation and the feeling you have at the time it happens”

You haven’t been listening to leaders like Ben during the 2010s because this “reality check” was widely unpopular, and not congruent with the constant hiring to fill in seats. It was the rationale that held true at the time - just not really meaningful in an ever-growing economy, hiding the secrets of operational deficiencies.

And I’ll talk about 2 more deficiencies mentioned at the beginning.

Halting the ads on LinkedIn and the newsletter

Running better inventory has become the norm since the 2022-2023 beginning of this recession in big tech. With consistent growth every quarter, trimming the fat is not a priority - first, the focus is elsewhere, and second, the second-order consequences of different investments are hard to measure.

In other words, paid ads or sponsorships or events or tradeshows do contribute “somehow” if the revenue is going up; how much and to what percentage is less obvious, but as soon as the company makes money, these details are less critical.

What we’ve been seeing in 2023 and 2024 (and some trickling into 2025) is a series of blanket cuts of teams, vendors, contractors, tools, other forms of spend. Then followed by more rigorous analysis from CFOs and boards, with some individual decisions to halt some activities, stop R&D spend, and often cut deeper than reasonable. 📉

I’ve been through several of these cycles - on the vendor side, as an advisor and consultant, as an investor for businesses doing the cuts, and internally across my companies.

We’ve seen many of these decisions lead to positive impact, and many that were horrendous (stopping the buckets that actually move the needle).

We’ve also halted some investments in different initiatives or R&D - and revisit these every few months.

⛑️ LinkedIn is one we stopped end of last year, restarted this one, but stopping once again.

Spending over $5k a month internally with abysmal engagement on thought ads or an endless pool of “quick apply” applicants is honestly wasting more time to manage and sift through the noise than not use it at all.

A system that has been dormant for over 2 years now, with no evolution or upgrades or improvements, featuring old posts and viral stories, simply isn’t a good investment at this time.

Meanwhile, we saw similar results with the ad campaigns toward the newsletter (Sparkloop being one example), and paused these over the weekend too. It’s also the second time we go through this exercise. The quality went down in 2023 and we paused, then improved end of 2024, but is packed with arbitrary emails since.

While certain initiatives make sense if the overall investment is worthwhile (capital, time, velocity, and quality), they may be put on the backburner if the equation no longer pans out.

The same premise is valid for the employment market - which is oddly quiet (and shouldn’t).

The AI gap and why employees should catch up ASAP

The job market is absolutely lagging behind, not because new hires aren’t needed, but the overall attitude toward work + what’s been offered isn’t generating the same ROI it did 3 years ago.

I’ve discussed that in previous newsletters (including last week) and reviewed the market data earlier in this bulletin above.

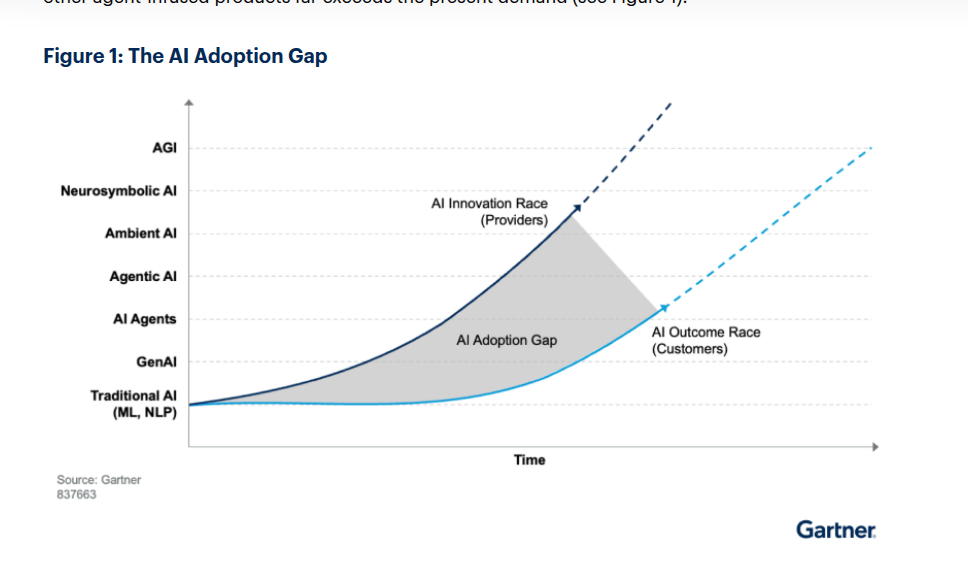

Gartner is talking about the AI adoption gap between innovation from AI providers and companies, but it’s equally valid for companies adopting AI vs. people on the market using legacy 2020 playbooks and tech:

AI is accelerating faster than companies and employees

Skilling up should be a number one priority for teams used to working a regular office job with little innovation, doing mundane tasks that could be automated easily, in an environment where human innovation or specific individual traits can’t be deployed with higher value compared to agents and AI systems.

👷 In other words, employees who work 40-hour work weeks, taking evenings and weekends off, plus PTO and some sick leaves, and work from home or have various asks and career needs and specific exceptions from hiring teams, are being compared with AI systems costing a few hundred dollars a month, working 24/7 generating results 20x faster that need overview and approval from a human.

And as velocity goes up, the actual need for “human capital” isn’t as pressing to justify all the added costs and risks of employment.

I’ll list down some resources around that in the sections below, but the fine print is:

📗 Spend the holiday breaks or the rest of December actively preparing for the new year, taking some courses, watching some videos on AI and current processes, and equipping with podcasts, newsletters, tools, and social accounts to start following throughout the next few months.

There’s a lot going on in the space, and I keep interviewing dozens of people who are at least 5 years behind on GTM processes or tools or principles or playbooks - and bridging this gap will take 6+ months which isn’t always justified.

👉️ Bridging that talent gap would support businesses in need of the right roles, right mindset, and right processes. But investment in self-training and following the industry trends should come from within.

Mario

My Take

🏫 Google is running a program for skilling up in AI (most courses are free):

👨🏭 On passion in the workplace - one of the impactful challenges with hiring now is the lack of joy in the workplace. We’ve been raised to admire education and study hard so we can work jobs we like, get paid well, and see the fruits of hard work. Somehow the employment market got crowded by people who managed to hack through the recruitment process and land a job that works on autopilot - which is exactly where all the layoffs cut through right now.

5️⃣ Hiring for culture (top 5 tips) - I authored this for Forbes in 2021 and as usual, it’s still just as valid. Here are the five traits applicants can master to excel at every interview.

🏴☠️ Surviving the trial period - for everyone who managed to land a trial, my Entrepreneur magazine guide on the core 6 KPIs to survive a trial may be the right thing you need to read today.

Books I read this month

“The Algebra of Wealth” by Prof. Scott Galloway (55% in)

“The Hard Thing About Hard Things” by Ben Horowitz (70% in)

“The Sweaty Startup” by Nick Hueber (85% in)

Ray Dalio’s “How Countries Go Broke: The Big Cycle” (55% in)

The FP&A Handbook: Mastering Financial Planning & Analysis (40% in)

“Revenue Architecture” by Jacco van der Kooij (55% in)

“Hooked” - on habits and cues and product alignment ✅

More from Our B2B Ecosystem

🔖 Act on engagement as it happens. Use real-time email tools to trigger follow-ups that respond to opens, clicks, and high-intent signals.

🔖 Make SEO reports boardroom-ready. These enterprise SEO metrics link performance to revenue and growth goals.

🔖 Stop API issues from halting campaigns. Improve martech reliability with these API compatibility checks and safeguards.

🔖 Monitor platforms more effectively. See how these AI monitoring platforms use automation to spot anomalies and optimize infrastructure.

🔖 Recover faster with hybrid cloud. Strengthen security using this hybrid recovery guide with strategies like RBAC and automation.

🔖 Improve your disaster recovery plan. Ensure continuity with a resilient cloud-based recovery strategy.

🔖 Find your market faster. These positioning frameworks help startups sharpen messaging at every stage.

🔖 Deliver personalization at scale. See how modern CDPs use AI to create more unified customer profiles.

🔖 Protect your time from distractions. Learn how interruptions hurt execution and why top performers block time for deep work.

Industry News for B2B Leaders

📰 Sarandos courts Trump. Netflix co-CEO Ted Sarandos contacts Trump during Warner Bros deal talks in a major regulatory push.

📰 Skild AI funding nears $14B. SoftBank and Nvidia lead a funding round valuing Skild AI at $14B for its hardware-neutral robot model foundation innovation.

📰 Macron warns on China trade. Macron signals tariffs on Chinese imports if Europe’s $143B trade gap with China does not improve.

📰 Ads come to Gemini. Google plans to integrate advertising into its Gemini chatbot by 2026, changing conversational commerce models.

📰 EU Greens target Big Tech. Green MEPs urge Brussels to fine big tech firms more to enforce platform compliance rules.

📰 Integral AI launches AGI model. Integral AI unveils an AGI-capable model that learns skills without guidance, marking a milestone in machine intelligence.

📰 Privacy becomes brand advantage. Marketers shift to first-party data and transparency as cookie deprecation makes privacy a key competitive moat.

📰 Meta acquires AI pendant. Meta buys Limitless to boost its AI wearables portfolio and drive conversational intelligence solutions.

📰 Neurodivergent fellowship begins. Palantir launches a fellowship spotlighting neurodivergent talent to foster innovative AI thinking.

M&A Opportunities

Let’s see the latest offers from Flippa. Don’t forget to sign up for their newsletter for daily/weekly/monthly offers like these.

Electronics eCommerce Brand: A five-year-old online store generating consistent profit through automated fulfillment and strong email marketing. With growth potential across new markets, it’s priced at $198,307 (reduced 26%).

Cloud Storage SaaS: A one-year-old SaaS brand offering hybrid lifetime and subscription options with excellent user reviews. High-margin, low-maintenance, and ready to scale - available for $270,000.

Prop Trading SaaS Platform: A fast-growing SaaS business supporting prop firms with a 50% profit margin and strong recurring revenue. With 200 active subscribers and solid retention, it’s offered at $749,000 (reduced 13%).

Amazon FBA Beverage Brand: A 1.5-year-old automated FBA business in the food and drink space, generating $28K monthly profit at 37% margins. Built for scalability and ease of operation, this brand is selling for $809,997 (reduced 10%).

AI Study Platform: A personalized learning SaaS transforming content into gamified quizzes and flashcards for over 10K paying users. With $26K monthly profit and growing ARR, this business is listed at $2,200,000.

Working with me

Here are the main projects I focus on:

🌐 Scaling $50M - $500M+ companies on top of WordPress. DevriX provides full RevOps consulting + delivery with GTM enablement for PE-backed portfolio companies, traditional tech, healthcare, finance, and professional service businesses pacing toward revenue growth initiatives. Our standard monthly retainers between $10K and $100K include revenue lifecycle services for marketing and sales leaders, FP&A for financial teams, pipeline enrichment through websites and dozens of lead sources, automations and delivery integrations, CRO and ongoing testing, product delivery and platform integration solutions, and more through our consulting solutions.

🚀 1:1 Consulting. At Growth Shuttle, I run two popular plans: Async Advisory ($3,500/mo) for $5M - $50M founders and executive teams and the smaller Strategic Growth Circle ($997/mo) for $100K - $1M entrepreneurs, agency founders, and scale ups.

📈 Building US LLCs from Europe. I help European and Asian founders scale faster through doola and their “Business in a Box” model. Also suitable for US citizens (given their bookkeeping solution), but in very high demand across Europe.

📊 Post-Merger Integration. I support M&A initiatives through Flippa’s marketplace. Working closely on PMI initiatives for PE companies and fast-growing startups integrating new companies within their portfolios, enabling data pipelines, and securing more deals through my personal network.